The Directorate General of Foreign Trade (DGFT), under the Ministry of Commerce and Industry, Government of India, issues a unique identification number known as the Import-Export Code (IEC). Any person or business that wants to participate in international trade by importing or exporting goods, and in specific regulated instances, services, must secure an IEC as a compulsory registration.

Multiple regulatory bodies, including customs authorities, authorized dealer banks, and trade policy institutions, govern India’s foreign trade system. The IEC acts as a central reference number across these frameworks, enabling:

- Identification of importers and exporters

- Monitoring of trade flows

- Regulatory and policy compliance

- Lawful movement of goods and foreign currency

This 10-digit alphanumeric code serves as your business passport in the international trade arena. Without this code, businesses cannot legally clear shipments through customs or receive payments from international buyers through banking channels.

Once issued, the holder uses the IEC as the primary reference number for all import and export transactions. For anyone planning to participate in cross-border trade from India, understanding the IEC – its meaning, applicability, application process, and compliance requirements – is essential.

When is the IEC Code Required?

You must obtain an IEC code before undertaking any commercial import or export activity governed by India’s foreign trade regulations. The requirement typically arises when regulatory oversight applies, most commonly at:

- The stage of customs clearance

- The time of receiving or remitting foreign exchange through authorized banks

You require an IEC when:

- Goods physically cross India’s borders for commercial purposes

- Indian banking channels route payments related to imports or exports.

This requirement applies even if you are involved in a transaction that is:

- Occasional

- Low in value

- The first international transaction you undertake as a business

Importantly, business size, turnover, or transaction frequency do not affect the requirement. Any commercial engagement you have with international markets under Indian law triggers the need for an IEC. Even if you are a small entrepreneur testing international markets, you must obtain this code before initiating trade activities.

Situations Where an Import-Export Code is Mandatory

The IEC code mandates most routine international trade scenarios, covering both traditional and modern business models. The digital transformation of global commerce has expanded the scope of IEC applicability.

Businesses must obtain an IEC when they:

- Import raw materials, components, machinery, or capital goods for commercial use

- Export finished goods, semi-finished products, or traded items to overseas buyers

- Operate through international e-commerce platforms involving cross-border shipments

In addition, an IEC is required when:

- Export proceeds are received in foreign currency

- Import payments are remitted abroad through authorized dealer banks

In each of these situations, authorities use the IEC to track transactions, enforce trade policy controls, and ensure compliance with customs and foreign exchange regulations.

Who is Required to Obtain an IEC Code?

Any individual or entity intending to act as an importer or exporter must obtain an IEC code. This requirement applies uniformly across industries and sectors.

Entities that require an IEC include:

- Manufacturers exporting goods produced in India

- Traders importing goods for resale

- Exporters supplying goods directly to foreign buyers

- Businesses integrated into global supply chains

The requirement applies equally to:

- Proprietorships

- Startups

- Partnerships and LLPs

- Large corporate entities

Businesses that operate solely within India, with no involvement in international trade, do not need to obtain an IEC. However, once they plan or initiate cross-border trade, they must register for an IEC. It’s advisable to obtain the IEC before entering into contracts with foreign buyers or suppliers.

Eligibility Criteria for IEC Code

The eligibility criteria for IEC registration are intentionally broad to promote ease of entry into international trade.

An applicant is eligible if they:

- Possess a valid Permanent Account Number (PAN) issued in India

- Maintain an active bank account

- Have a verifiable business or residential address supported by documents

There are no statutory requirements relating to:

- Minimum turnover

- Capital investment

- Prior import-export experience

Since the IEC authorities issue it on a PAN basis, only one IEC is allotted per PAN. This single code applies to all branches, offices, and units linked to that PAN. Therefore, businesses operating from multiple locations don’t need separate IECs for each branch.

Steps to Obtain an Import Export Code in India

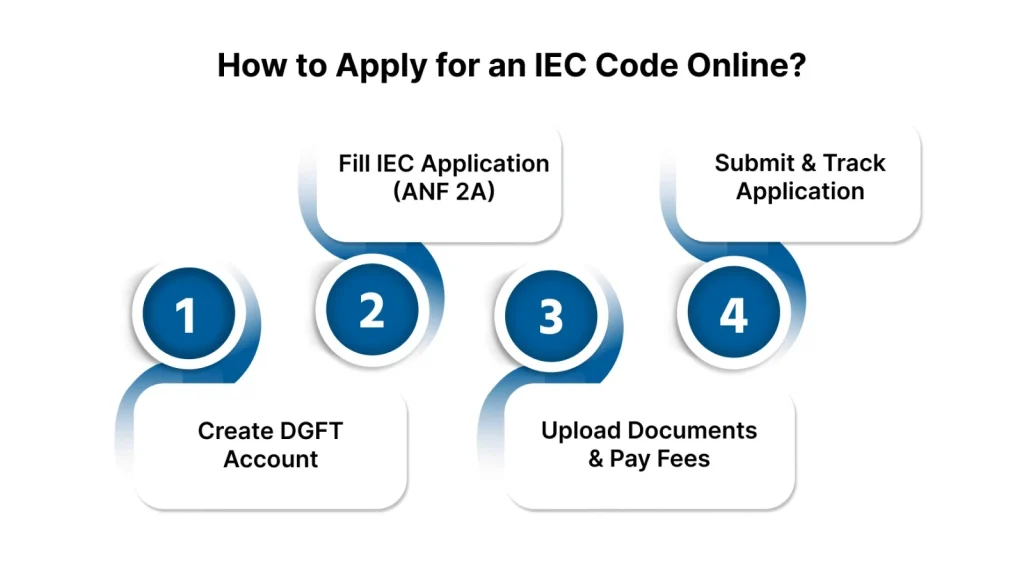

The IEC application process is conducted entirely online through the DGFT portal, making it standardized and accessible nationwide.

The process involves the following steps:

- Creating a DGFT user account using PAN, mobile number, and email ID

- Filling out the IEC application form with identity, address, and bank details

- Uploading the required supporting documents

- Paying the prescribed application fee online

Once submitted, the DGFT verifies the details electronically and issues the IEC code, which they make available for download. In most cases, the DGFT issues the IEC within one to two working days.

IEC Code Application Process Overview

| Stage | Description |

| Registration | Create a DGFT account using PAN |

| Application | Complete the IEC application form |

| Documentation | Upload required documents |

| Fee Payment | Pay the application fee online |

| Verification | DGFT verifies submitted details |

| Issuance | IEC issued electronically |

Documents Required to Apply for an IEC Code

Accurate and complete documentation is essential for successful IEC registration, as it forms the basis of DGFT’s verification process.

The commonly required documents include:

- PAN card of the individual or business entity

- Proof of address (electricity bill, telephone bill, rent agreement, sale deed, or GST registration certificate)

- Bank account proof, such as a cancelled cheque or bank-issued certificate

Companies and LLPs require additional documents, such as the certificate of incorporation and constitutional documents.

All documents must be valid, clearly legible, and consistent with the information provided in the application. Even minor discrepancies may result in delays or clarification requests.

How the IEC Code is Used in Import and Export Transactions

Once issued, the IEC becomes an integral part of import and export operations. It is quoted on key trade documents such as:

- Shipping bills

- Bills of entry

- Customs declarations

Customs authorities use the IEC to identify the responsible importer or exporter, assess duties, and enforce trade policy provisions. Banks rely on the IEC to process import payments and export proceeds in compliance with foreign exchange regulations. Beyond individual transactions, the IEC also enables authorities to aggregate trade data and monitor compliance patterns.

Validity of IEC Code and Update Requirements

The IEC is issued with lifetime validity and does not require renewal. However, IEC holders must comply with ongoing update obligations.

Any changes relating to:

- Business address

- Bank account details

- Ownership or constitution

must be updated on the DGFT portal within the prescribed timeframe. Additionally, DGFT mandates annual confirmation or updating of IEC details, even if no changes have occurred.

Failure to comply may result in the temporary deactivation of the IEC, during which import-export activities cannot be undertaken.

Difference Between IEC Code and Import-Export License

The IEC code and an import-export license serve different regulatory purposes.

IEC Code: Acts as a basic identification number enabling participation in international trade

Import-Export License: A specific authorization required only for certain restricted or regulated goods

While an IEC is mandatory for most trade activities, licenses apply only in product-specific or policy-controlled cases. Holding an IEC does not exempt an individual from obtaining a license where one is required.

Cases Where the IEC Code Is Not Required

IEC is not required in limited and clearly defined situations, such as:

- Imports made for personal use, not connected to trade, manufacture, or resale

- Certain transactions by government departments or public institutions are under specific exemptions

These exemptions are narrowly applied. For most commercial import-export activities, obtaining an IEC remains mandatory.

Conclusion

India’s international trade framework relies on the Import Export Code (IEC) as a cornerstone. To participate legally and efficiently in global trade, businesses must understand the full form of the IEC, know when they need it, prepare the correct documents, and comply with updated obligations.

The IEC serves as a unified identifier across customs, banking, and regulatory systems, promoting transparency, compliance, and structured growth in international commerce. Therefore, any individual or business planning to engage in cross-border trade from India must obtain and maintain an active IEC before initiating import or export operations.

FAQs

The DGFT issues an IEC Code, a 10-digit identification number, which importers and exporters use to clear customs, receive foreign payments, and conduct international trade legally in India.

Yes, you can apply for an IEC Code completely online through the DGFT portal, where the process is paperless, quick, and user-friendly as long as you upload accurate documents.

Yes, service providers must obtain an IEC Code to export services outside India, receive foreign currency payments, and comply with DGFT regulations.

Individuals importing or exporting goods for personal use, government departments, and certain notified institutions do not need to register for an IEC Code.

DGFT usually issues the IEC Code within a few working days after you submit a correct application with valid documents.