Individuals, professionals, and businesses in India must file income tax returns as a crucial compliance requirement. As we step into 2026, they have made tax filing more transparent, technology-driven, and closely monitored. While digital platforms, pre-filled returns, and automated checks simplify the process, even minor errors can now lead to delayed refunds, interest charges, tax demands, or notices from the Income Tax Department.

For Assessment Year 2025–26, authorities heavily rely on third-party data from employers, banks, mutual funds, insurance companies, and investment platforms. Tools like the Annual Information Statement (AIS) and Taxpayer Information Summary (TIS) enable taxpayers to automatically cross-verify income, deductions, and high-value transactions. Understanding common ITR filing mistakes for AY 2025–26 is therefore essential for taxpayers to ensure smooth, accurate, and hassle-free tax compliance in 2026.

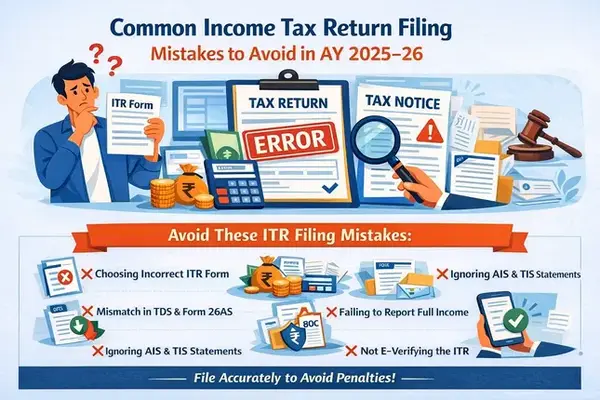

This blog highlights the most frequent mistakes taxpayers make and offers them practical tips to avoid those mistakes.

Choosing the Wrong ITR Form

Taxpayers continue to select the incorrect ITR form as one of the most common mistakes. Each ITR form is designed based on the taxpayer’s income sources, residential status, and nature of activities during the financial year. Filing an inappropriate form may render the return defective and require correction within a limited timeframe.

Many salaried individuals assume that ITR-1 applies to all employees, without considering income from capital gains, multiple house properties, foreign assets, or professional work. Similarly, freelancers and consultants sometimes incorrectly file salaried returns, leading to compliance issues.

Recommended approach: Taxpayers should carefully analyse all income sources, including salary, interest, capital gains, rental income, and professional receipts, before selecting the applicable ITR form.

Confusion Between Financial Year and Assessment Year

Individuals filing taxes for the first time often mix up the financial year with the assessment year. Taxpayers must report income earned during the period from 1 April 2024 to 31 March 2025 for Assessment Year 2025–26. Selecting the wrong assessment year results in an invalid return and often requires refiling.

Such errors may delay refund processing and create unnecessary compliance complications.

Key consideration: Taxpayers should always verify the assessment year displayed on the income tax portal before proceeding with return filing.

Errors in Personal, Contact, and Bank Details

Incorrect personal or banking details can disrupt the entire return processing cycle. Errors in PAN, Aadhaar number, date of birth, email ID, or bank account information often lead to refund failures or verification delays. PAN–Aadhaar mismatches are particularly sensitive and may even prevent return filing or e-verification.

Best practice: taxpayers should ensure PAN is linked with Aadhaar, contact details are updated, and bank account information is accurately entered and pre-validated on the income tax portal.

Not Disclosing All Sources of Income

Taxpayers often fail to disclose all income sources, which is one of the most serious mistakes in income tax return filing. Many taxpayers focus solely on salary income and unintentionally overlook interest earned from savings accounts, fixed deposits, or recurring deposits. Taxpayers frequently miss income from capital gains, dividends, rental properties, and freelance or consultancy work.

Since AIS and TIS capture most financial transactions, authorities easily detect undisclosed income, which may result in scrutiny or reassessment.

Recommended approach: Taxpayers should review bank statements, investment summaries, Form 16, capital gains reports, and AIS data to ensure that all income sources are fully and accurately disclosed.

“Make sure no income is left undisclosed – verify everything easily with CAAFT”

Blind Reliance on Pre-Filled Return Data

Pre-filled ITR forms have simplified compliance, but taxpayers should not treat them as final or error-free. Reporting entities may not have updated data correctly, resulting in missing income streams or deductions. Relying entirely on pre-filled information without verification may result in incorrect tax computation.

Best practice: Taxpayers should cross-check pre-filled information with Form 16, interest certificates, investment proofs, and transaction statements before submitting the return.

Mismatch of TDS with Form 26AS

Form 26AS reflects tax deducted at source, advance tax payments, and self-assessment tax deposited. Taxpayers often claim TDS that does not appear in Form 26AS, which is a common mistake often leads to reduced refunds or additional tax demands.

This mismatch usually occurs due to delayed TDS filings or incorrect PAN reporting by deductors.

Recommended approach: Taxpayers should reconcile TDS claimed in the return with Form 26AS and supporting TDS certificates before filing.

Ignoring AIS and TIS Statements

The AIS and TIS offer a comprehensive overview of financial transactions that have been reported to the Income Tax Department. These statements include details of interest income, dividend income, securities transactions, and high-value purchases. Taxpayers who ignore AIS and TIS significantly increase the risk of mismatches.

Key consideration: Taxpayers should carefully review AIS and submit feedback for any incorrect, duplicate, or unrelated transactions before filing the return.

Salary Income from Multiple Employers Not Reported Properly

Taxpayers who change jobs during the financial year often receive Form 16 from more than one employer. A common mistake occurs when taxpayers report income from only the most recent employer, which results in under-reporting of income and incorrect tax liability.

Recommended approach: Taxpayers should consolidate salary income from all employers during the financial year and report the total income in the return.

Incorrect or Incomplete HRA Claims

Taxpayers frequently claim House Rent Allowance (HRA) incorrectly due to missing documentation, incorrect rent calculations, or absence of HRA in the salary structure. Incorrect claims may result in adjustments during processing or scrutiny at a later stage.

Best practice: Taxpayers should claim HRA only if it is part of the salary structure and supported by valid rent receipts or rental agreements.

Failure to Claim Eligible Deductions

Many taxpayers pay more tax than required due to failure to claim deductions under sections such as 80G, 80D, 80C, and 80CCD(1B). This often happens due to lack of documentation or incomplete review before filing.

Recommended approach: Taxpayers should maintain proper records of investments and expenses and review all eligible deductions carefully before filing the return.

Not Paying Advance Tax When Required

If the total tax liability exceeds ₹10,000 in a financial year, taxpayers must pay advance tax. Failure to comply attracts interest under Sections 234B and 234C, increasing the overall tax burden.

Key consideration: Taxpayers should estimate tax liability periodically during the year and ensure advance tax is paid within prescribed installments deadlines.

Misunderstanding the Taxability of NSC Interest

Taxpayers often incorrectly assume that interest earned on National Savings Certificates (NSC) is entirely tax-free, even though it qualifies for deduction under Section 80C when reinvested.

Best practice: taxpayers should include NSC interest as taxable income each year while claiming the applicable deduction.

Failure to E-Verify the Income Tax Return

Taxpayers complete filing an income tax return without verification. If the return is not verified within the prescribed time limit, authorities treat it as invalid and consider it not filed.

Recommended approach: Taxpayers should complete e-verification immediately after filing using Aadhaar OTP, net banking, or bank account verification methods.

“Avoid income tax return rejection – verify your ITR today with CAAFT”

Ignoring Notices and Communication from the Tax Department

Taxpayers who ignore emails, SMS alerts, or portal notifications from the Income Tax Department can face penalties, interest, or best judgment assessments. Most Income tax notices require prompt response and are time-sensitive.

Key consideration: taxpayers should regularly monitor their registered email ID and income tax portal dashboard and respond to notices within specified deadlines.

Non-Disclosure of Foreign Assets and Liabilities

Taxpayers holding foreign bank accounts, overseas investments, or foreign properties must disclose these details in Schedule FA. Non-disclosure can attract severe penalties under the Black Money Act, even if the income is minimal.

Best practice: taxpayers should disclose all foreign assets, income, and liabilities accurately, including dormant accounts.

Conclusion

Taxpayers must avoid Income tax return filing mistakes for accurate and compliant income tax filing in 2026. With increased transparency, automated data matching, and stricter reporting requirements, careful review and attention to detail have become more important than ever.

By following the recommended approaches, best practices, and key considerations discussed above, taxpayers can minimize errors, avoid unnecessary notices, and ensure timely processing of returns and refunds. Staying informed, organised, and proactive remains the most reliable way to achieve error-free income tax compliance in 2026.

FAQ’s

A: Taxpayers commonly make mistakes such as choosing the wrong ITR form, not reporting all income sources, claiming incorrect deductions, mismatching TDS with Form 26AS, and failing to verify the return after filing.

A: Taxpayers must disclose all income because the department cross-checks data using AIS and TIS. Missing income, such as bank interest, capital gains, or freelance earnings, can trigger notices, reassessment, or additional tax demands.

A: If taxpayers claim TDS that does not appear in Form 26AS, the department may reduce refunds or raise tax demands. Reconciling TDS details before filing helps avoid this common ITR filing mistake.

A: Many taxpayers fail to claim deductions due to poor documentation or a lack of review. Deductions under Sections 80C, 80D, 80G, and 80CCD(1B) can significantly reduce tax liability if claimed correctly.

A: Non-disclosure of foreign assets attracts severe penalties under the Black Money Act, even if the income from those assets is minimal.

A: Ignoring notices can result in penalties, interest, or best judgment assessments. Prompt responses help resolve issues before they escalate.