The Goods and Services Tax (GST) has streamlined India’s indirect tax landscape by unifying multiple taxes under one structure. While GST registration is mandatory for many businesses, there are circumstances where it may no longer be necessary. In such cases, taxpayers can apply to cancel their GST registration.

Cancelling GST registration is not as straightforward as merely stopping business operations; it involves meeting specific eligibility criteria, accurately completing forms, and fulfilling post-cancellation responsibilities. This guide details how to navigate the cancellation process, explores reasons for cancellation, outlines required documents, and describes subsequent obligations.

Understanding the Cancellation Process

Cancelling GST registration involves officially deactivating a business’s GSTIN on the portal. Once canceled, the business cannot charge GST, claim Input Tax Credit (ITC), or file regular returns. Instead, a final return (GSTR-10) must be filed to complete all GST obligations.

The cancellation process can be initiated by either the taxpayer or the GST department, but it only takes effect after review and approval by a GST officer. For example, a business that closes due to low profitability must cancel its GST registration to officially end compliance requirements and avoid penalties for missed filings.

What does GST Cancellation mean?

GST cancellation formally terminates your registration under the GST law. After cancellation, you:

- Cannot issue GST-compliant invoices

- Cannot collect GST from customers

- Are ineligible to claim ITC on purchases

- Must file a final GST return

In essence, GST cancellation dissolves your tax relationship with the indirect tax system unless you resume operations and apply for a new registration.

Reasons for Cancelling GST Registration

There are several genuine business and compliance-based reasons for cancelling GST registration. Below are the most common ones, explained with simple examples to make them easier to understand.

1. Permanent closure of business

If a business shuts down, continuing GST registration becomes unnecessary. Missing required filings can lead to penalties.

Example: A boutique owner closes her store but must still file nil returns unless she cancels her GST registration.

2. Turnover falling below the threshold limit

Businesses are required to register under GST only if their annual turnover exceeds a specified limit. If revenue consistently falls below this threshold, cancellation can reduce compliance burdens.

3. Transfer, Merger, or Sale of Business

When ownership changes due to a sale, merger, or inheritance, the existing GSTIN becomes invalid. The original registration must be canceled.

Example: A father transfers his printing business to his daughter, necessitating a cancellation of the original GSTIN.

4. Change in Business Structure

If a business transitions from a proprietorship to a partnership, a new GST registration is required..

5. Switching to Exempt Goods or Services

If a business only provides exempt goods or services, a GSTIN is no longer necessary.

6. Voluntary Registration no longer needed

Some businesses register voluntarily to access benefits like ITC but may choose to cancel if these benefits are no longer relevant.

7. Reducing Compliance Burden

Businesses with lower activity levels often find GST compliance too demanding. Canceling registration can alleviate paperwork and penalties.

Types of GST Cancellation

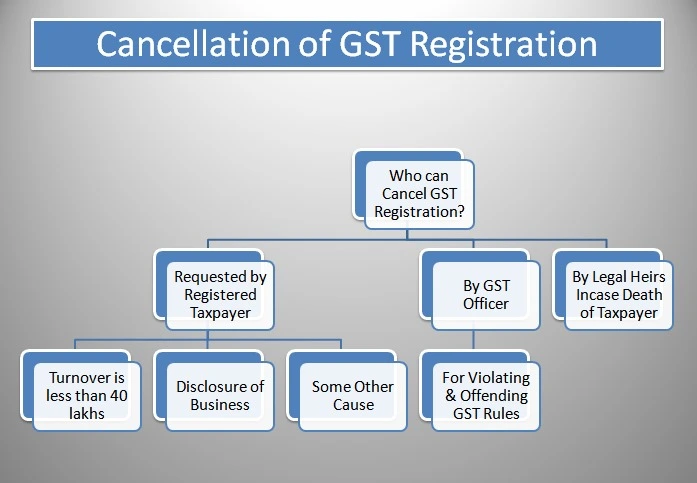

GST cancellation can happen in two ways, depending on who initiates the process.

1. Voluntary Cancellation by the Taxpayer

A registered person can choose to cancel if:

- They have ceased operations

- Their turnover is below the registration threshold

- Their business structure has changed

- GST registration is no longer needed

2. Department-Initiated Cancellation

The GST department may cancel a GSTIN if:

- Returns are not filed for an extended period

- Registration was obtained through false information

- The business is non-operational

- Invoices are issued without actual supply

- ITC claims are fraudulent

In such cases, taxpayers can respond to notices or apply for revocation if they wish to continue their business.

Eligibility Criteria for GST Cancellation

Taxpayers can apply for cancellation if:

- The business is permanently closed

- Ownership has been transferred or sold

- Turnover falls below mandatory registration limits

- The business structure has changed

- Voluntary registration is no longer needed

- All pending dues and returns are settled

If any returns or liabilities are outstanding, the GST portal will not permit cancellation until those issues are resolved.

Documents Required for GST Cancellation

Required documents vary based on business type and reasons for cancellation. Typically, you may need:

- Proof of business closure (if applicable)

- Transfer or merger deed

- Statement detailing stock and capital goods

- ITC reversal calculations

- Payment challans for any outstanding liabilities

- Acknowledgment of the most recent GST return

- Identity proof of the authorized signatory

Submitting accurate documentation ensures a smoother cancellation process.

How to Cancel GST Registration: Step-by-Step Process

- Choose the Reason for Cancellation: Select the relevant reason, such as:

- Closing the business

- Transfer of ownership

- Change in business constitution

- Turnover below threshold

- Provide Important Details: Enter required information such as:

- Date of closure

- Stock and capital goods information

- ITC reversal details

- Outstanding liabilities

- Providing accurate information helps avoid delays in processing.

- Upload Supporting Documents: Attach the necessary documents based on your cancellation reason.

- Verify and Submit the Application: Use DSC, e-sign, or OTP for verification. After submission, you’ll receive an Application Reference Number (ARN) for tracking.

- Review and Approval by GST Officer: A GST officer will review your application. If all details are correct, they will issue Form GST REG-19, confirming cancellation.

Responsibilities After GST Cancellation

Post-cancellation, several responsibilities remain:

- Filing the Final Return (GSTR-10): This must be filed within three months of cancellation or the cancellation order, whichever comes first. It includes:

- Stock details

- ITC reversal

- Tax liability on closing stock

- Any outstanding dues

- GSTR-10 formally closes the taxpayer’s GST account.

- Clearing Pending Liabilities: Ensure that any unpaid taxes, penalties, or interest are settled before or shortly after cancellation.

- Maintaining Records for Six Years: Taxpayers must preserve records for at least six years from the cancellation date, which may be necessary for audits or investigations.

- Stop Using the Old GSTIN: The canceled GSTIN must not be utilized on invoices or websites, as misuse can lead to penalties.

Common Mistakes to Avoid during GST Cancellation

Many cancellation applications face delays due to simple errors. To avoid complications, refrain from:

- Applying without addressing all pending returns

- Incorrectly reporting stock or ITC details

- Submitting incomplete documentation

- Ignoring notices from the GST department

- Forgetting to file the final return (GSTR-10)

Preparing the necessary information in advance facilitates a smoother approval process.

Conclusion

By submitting accurate details, uploading proper documentation, and filing the final return on time, taxpayers can exit the GST system smoothly. Avoiding common mistakes and completing post-cancellation formalities also ensures there are no future complications or penalties.

Whether you are closing a business or simply reorganizing your operations, following the correct cancellation procedure ensures compliance and peace of mind.